Apple Card

The Apple Card is a fantastic credit card experience. I received mine a few weeks ago. You probably aren't thinking of getting another credit card - but let me tell you why you should consider an Apple Card.

First, let me describe which cards I use and why.

Amazon Prime Rewards Visa Signature Card

This card earns 5% back on all Amazon (and Whole Foods, etc.) purchases. No annual credit card fee, no foreign transaction fees, and no earnings caps. This is a no brainer. You should be making 100% of your Amazon purchases using this card.

You get 2% back on restaurants, gas stations, and drug stores. But you can do better than this.

Now, if you travel even moderately…. See my pro traveler tips for how I approach travel credit cards.

Chase Sapphire Reserve or Preferred card

This card earns 3 points on any travel, transportation, or dining related purchases. You can then spend those points and get a 50% bonus when making flight reservations that earn you miles. There is simply no more leveraged way to make money if you travel. Transportation & Travel is a broad category for Chase and covers things like paying tolls, ferries, planes, uber, taxi, trains, flights, travel agents, hotels (and any charges in a hotel like restaurants).

So how does this work? Say you spend $3,000 on plane tickets and hotel rooms. You will earn 9,000 points. Now you can go and spend those 9,000 points on an airline ticket the next time you fly, and that will be worth 13,500 points to spend or approx $150. So your $3,000 travel spent earned you $150 or 5% back. And that airline ticket is a revenue ticket meaning you earn miles on it. All of you folks that have an Alaska Credit card or other airline card and use it to purchase tickets because you get 3 points per dollar - this is not as good a deal as Chase. I have an Alaska card only for the $99 companion fare and nothing else. And when you use those Alaska Points to purchase a “free” ticket - you don’t earn miles on that ticket towards status. Bad deal.

In addition to this, you get a few other benefits like $300 travel credit per year and fantastic car rental insurance when traveling internationally as well as lounge access through Priority Pass.

Not quite as good as the Chase card and comes with a high annual fee, but you can recoup nearly all of it.

$200 of uber credit per year (can be used on Uber Eats)

$100 of credit at Saks Fifth Avenue

$200 Airline Fee Credit

Access to all the Amex Lounges worldwide - and this is the best benefit.

The Amex card is useless to use as a spending card in my experience, so I don't use it.

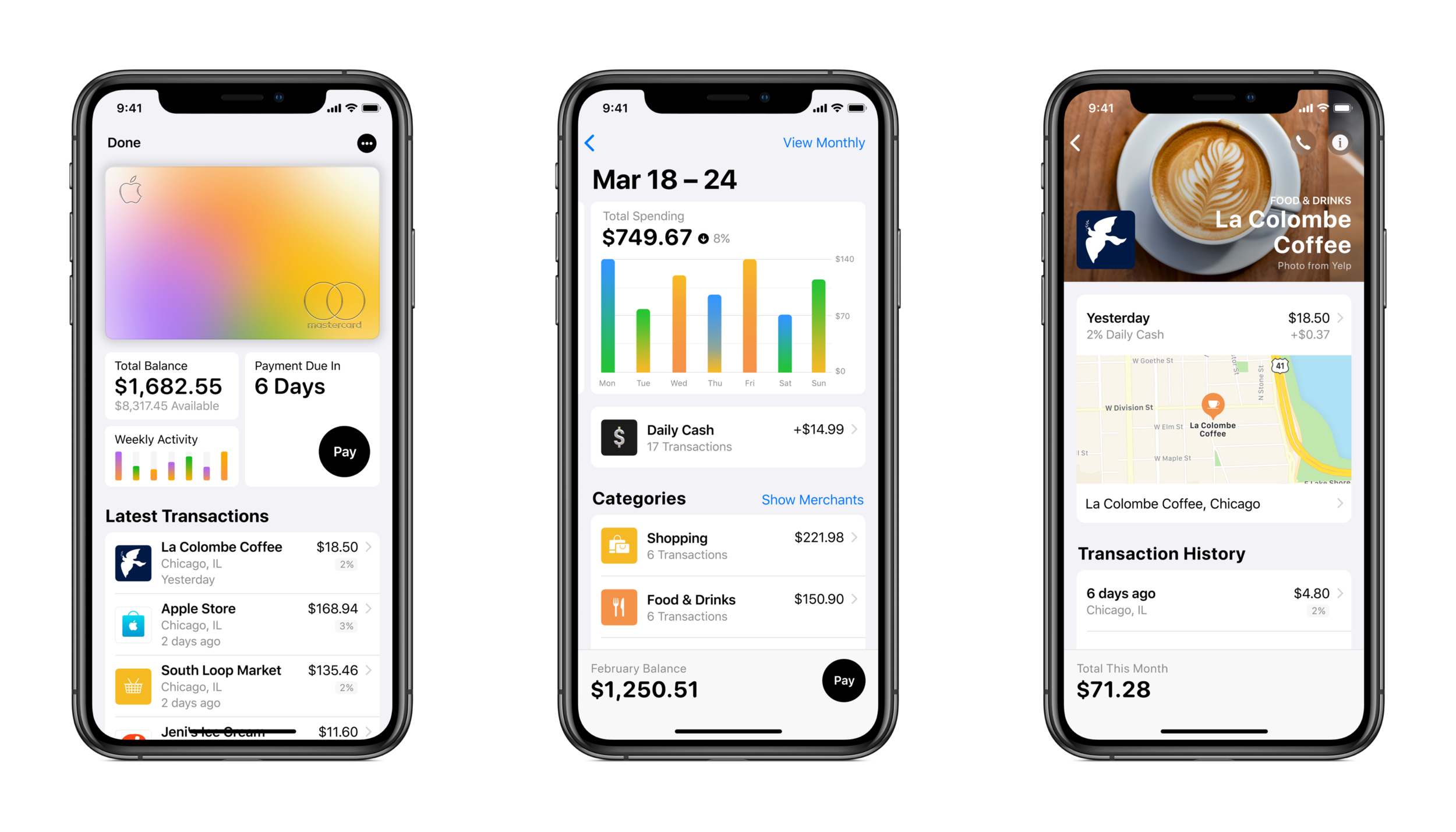

The Apple Card is an exciting twist on credit cards. It's designed to be used if you are an iPhone user as there is no web site or anything to check your spending. It's all done on the phone.

There is an optional physical credit card, and it has no credit card number printed on it because it's all digital. I have found that at least once a year, one of my credit cards is compromised, and with the Apple Card, it does not matter as you can lock or change your number any time you wish to inside the app.

The application and setup experience was pretty innovative. When you get your card, you activate it all on the phone. Like you would expect, Apple gets an A here for the experience.

Benefits

3% cashback on all Apple purchases (phones, App Store, iTunes, subscriptions). Apple has expanded this category to include Uber, Uber Eats, Walgreens, Duane Reade, and in T-Mobile stores

2% cashback on all Apple Pay transactions

1% on all physical card purchases

If you purchase anything from Apple (iPhones, MacBooks, iPad, AirPods) or digital goods (movie rentals, music, subscriptions, apps), you get 3% back.

If you make an Apple Pay purchase for anything, you get 2% back.

That is a screaming deal. That cashback is deposited daily into your Apple Cash account, which you can then use to pay your bill or transfer to your checking account.

There are other benefits to the card, like no foreign transaction fees. The card itself has no annual fee.

Apple has some helpful software tricks, such as seeing information about the merchant you purchased from. Things every credit card should be doing.

Bottom line - this is a good experience and better than any other credit card I've used.

Here is my workflow for credit card spending

Amazon Purchases + Amazon owned companies - Chase Amazon Card

All Travel, Restaurants and Transportation (online, physical, Apple Pay) - Chase Sapphire Reserve

All Apple Purchases and all Apple Pay Purchases that are not Travel, Restaurants and Transportation (I use Chase Sapphire Reserve for) - Apple Card

All purchases not covered by the above - Chase Sapphire Reserve

All recurring charges like NYTimes, AT&T Now - PayPal because I don’t have to worry about credit card compromise or expiration dates